Preserve the History of Ridgefield

Why Give to the Ridgefield Historical Society

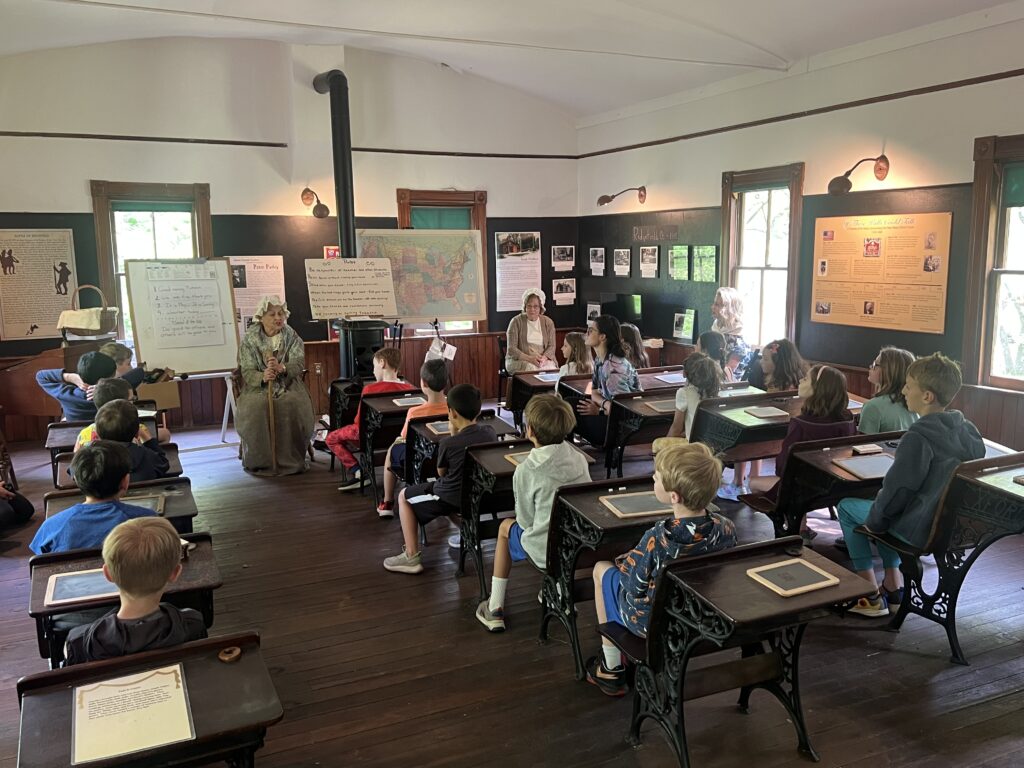

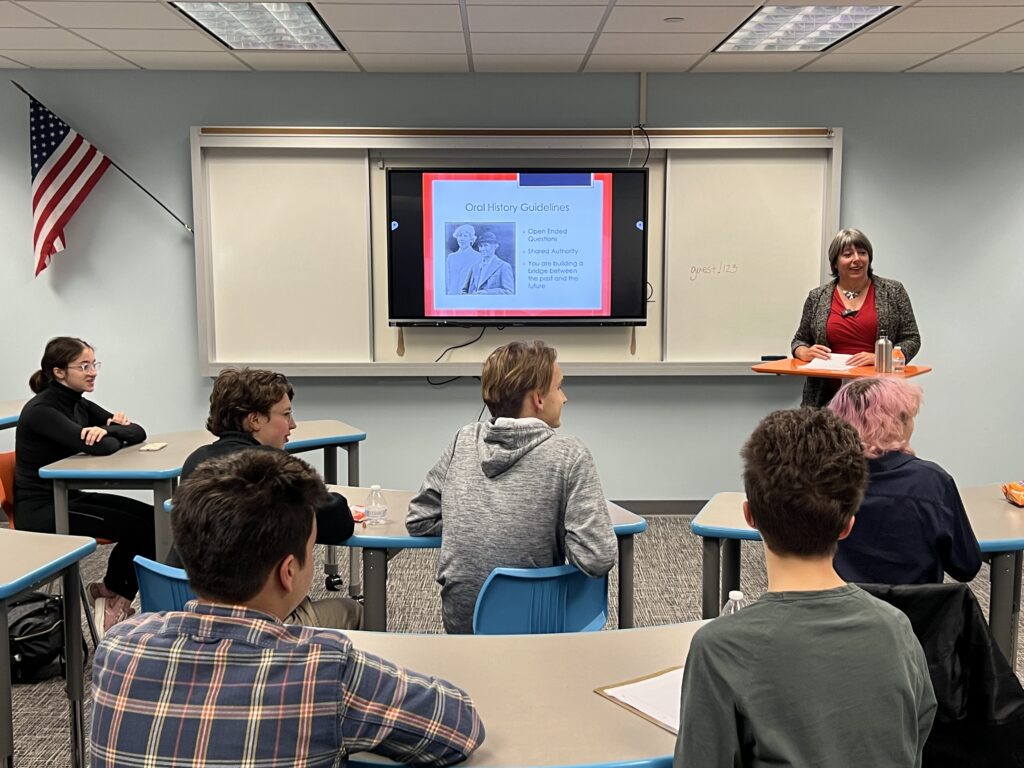

It’s because of the passion and dedication of our supporters that the Ridgefield Historical Society is able to preserve and share the amazing history of our beautiful town. A future commitment ensures that the places, stories, and objects that matter, those that make up the fabric of Ridgefield, are preserved for generations to come. Help us tell the story of our heritage by giving a future gift to the Ridgefield Historical Society.

Ways to Make Ridgefield’s History Your Legacy

A Gift in Your Will or Trust

With as little as one sentence, you can make a gift in your will or trust that significantly impacts the efforts of the Ridgefield Historical Society to preserve the history of Ridgefield. Whether you choose to give a set amount or a percentage of your estate, your support ensures we have the resources to save Ridgefield’s historic places.

Charitable Gift Annuities

Feel confident that you have dependable income in your retirement years with a charitable gift annuity. You transfer cash or appreciated securities to the Historical Society in exchange for fixed income payments for life. This gift can provide you with regular payments and provide the Ridgefield Historical Society the resources to preserve Ridgefield’s history. You can also qualify for a variety of tax benefits, including a federal income tax charitable deduction when you itemize.

Retirement Plan Assets

Retirement plan assets are a great way to support the work at the Ridgefield Historical Society because they not only help preservation efforts, but they also can provide tax relief for your loved ones. By making the Ridgefield Historical Society a beneficiary of all or part of your retirement plan you will dramatically lower future taxes, and can diminish income and estate taxes that can consume your account, while helping support your passion for saving Ridgefield’s historic places.

A Gift From Your IRA

If you are 70½ years old or older, you can take advantage of a simple way to give to the Ridgefield Historical Society and receive tax benefits in return. You can give up to $100,000 from your IRA directly to a qualified charity without having to pay income taxes on the money.

Gifts of Real Estate

When you give the Ridgefield Historical Society appreciated property you have held longer than one year, you qualify for a federal income tax charitable deduction. This eliminates capital gains tax. And you no longer have to deal with that property’s maintenance costs, property taxes or insurance. Donate residential, commercial or undeveloped real estate outright, or you can give the title of your home now and retain the right to live there for your lifetime, and provide support for preservation efforts in Ridgefield.

Gifts of Stock or Mutual Funds

If you’re looking for a tax-smart and simple way to save Ridgefield’s history, consider a gift of stock. When you give appreciated stock or mutual funds that you’ve owned for more than one year, you can avoid capital gains tax and receive a charitable income tax deduction when you itemize.

Our philanthropy team is eager to speak with you about how your giving can advance the mission and goals of the Ridgefield Historical Society and help preserve the history of Ridgefield. Please contact Executive Director Stephen Bartkus at [email protected] or 203-438-5821.